Recommended

5 Best Crypto Leverage Trading Platforms in 2025

If you have limited capital but wish to trade cryptocurrencies, leverage may be the answer. Although potentially hazardous, the increased access to capital will enable you to magnify profitable transactions.

This article analyzes the nine top platforms for crypto leverage trading in 2024. In addition to safety, leverage limits, fees, and commissions are also examined in our evaluations.

Best Leverage Trading Platforms

Now let’s go into our in-depth analyses of the top platforms that provide leveraged cryptocurrency trading.

1.BTCC

BTCC is one of the oldest / most established cryptocurrency exchanges, supporting some of the most prominent cryptocurrencies on the market, including Bitcoin, Litecoin, and Ethereum. The exchange has comparatively minimal trading fees for its users.

The exchange has seen 3+1 Bitcoin halvings and boasts a perfect 13-year streak without any security issues.BTCC has been in operation for more than a decade, serving over 2 million people and adding new members every year.

BTCC offers futures trading, allowing customers to leverage up to 225 times on over 300 USDT-margined and coin-margined perpetual contracts. Traders might earn from holding either short or long holdings.

If the user does not have USDT, it will offer to trade it at BTCC. This application allows users to rapidly convert over 200 different cryptocurrencies into USDT and trade USDT-margined futures on the platform.

The BTCC Conversion Function is a great addition to any trader’s toolkit. This allows BTCC clients to change their cryptocurrency into USDT in seconds. This eliminates the need for users to go through the time-consuming procedure of transferring cryptocurrency out of their wallet and then converting it to USDT.

Pros

- The exchange offers one of the most diverse ranges of futures, including daily, weekly, quarterly, and perpetual futures.

- Flexible leverage is available from 10x to 150x.

- BTCC offers one of the industry’s lowest trading fees at 0.03%.

- The copy trading feature is accessible, which allows for even more profits.

Cons

- The exchange is more centralized than its contemporaries.

- BTCC offers fewer fiat deposit choices than other exchanges.

Trade on BTCC Now

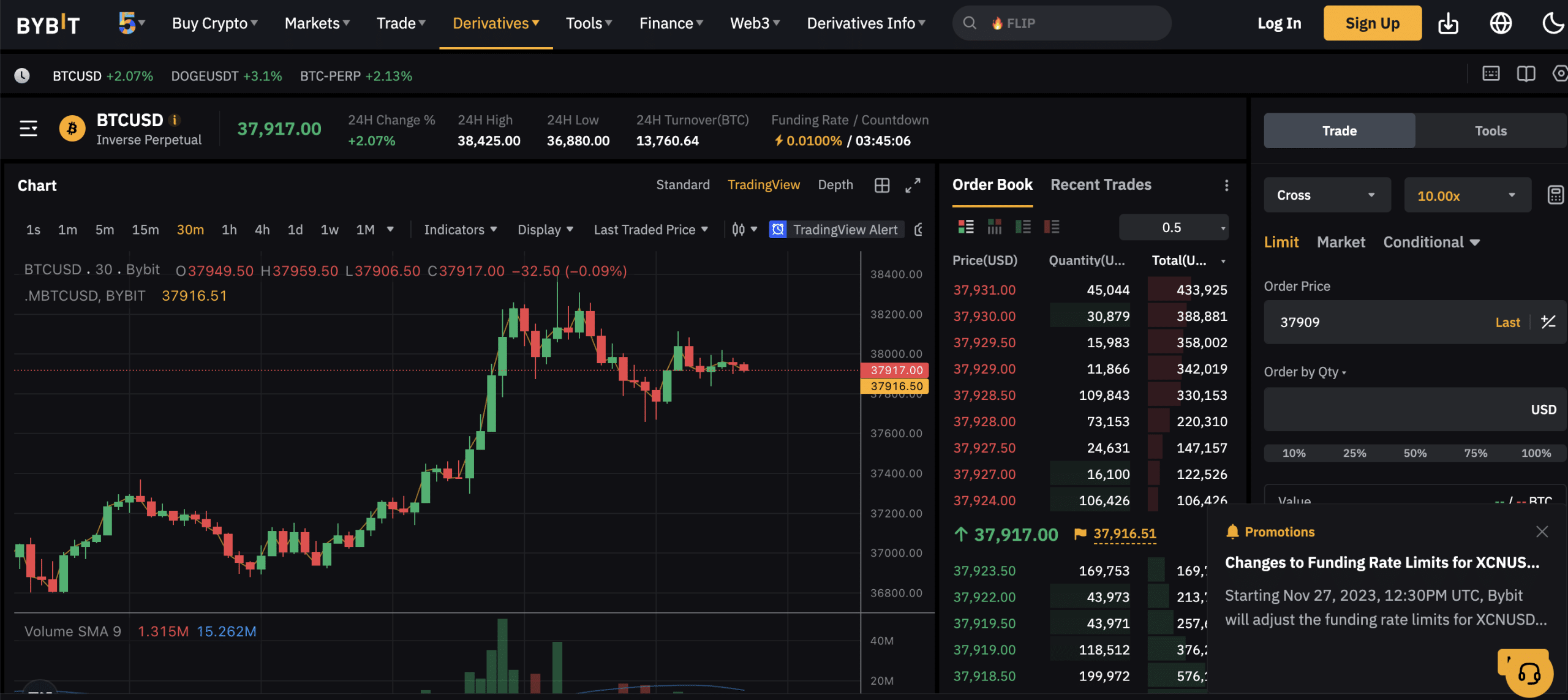

2.Bybit

In the realm of cryptocurrency leverage trading, Bybit is another option to think about. In the last day, users of Bybit exchanged cryptocurrency valued at over $2 million. As a result, you’ll have access to substantial amounts of liquidity. Plus, there is a vast selection of leveraged items available from Bybit. Included in this category are perpetual futures; Bitcoin’s maximum leverage is 125x.

Ethereum, Dogecoin, Solana, and XRP are among the supported cryptocurrencies. On the other hand, the leverage limitations for cryptocurrencies are smaller. Traditional cryptocurrency futures are also available on Bybit, albeit they currently only work with Bitcoin and Ethereum. The contract’s expiration date can be anywhere from 2023 to 2024.

When it comes to crypto leverage trading platforms, Bybit is among the top options for ‘inverse’ contracts. These function similarly to futures contracts, however instead of USDT, the underlying cryptocurrency is used for settlement and margining. Futures commissions begin at 0.055% and options commissions at 0.02%. The spot trading fees offered by Bybit are competitive as well; market takers pay a little 0.1% each slide.

Pros

- 125x leverage is available on perpetual Bitcoin futures.

- Accommodates both long and short positions

- Furthermore backs conventional futures and options

- The underlying cryptocurrency is used to settle and margin inverse contracts.

Cons

- Slightly more expensive trading fees for futures than other platforms

- The regulatory status is still unclear.

3.Binance

When it comes to cryptocurrency leverage trading platforms, Binance is among the top. More than 600 different cryptocurrencies are compatible, and they all have leverage features. When it comes to this, you have a couple of options. To start, the vast majority of traders will bet on futures that never expire. Leverage on Bitcoin futures is up to 125x on Binance, while other cryptocurrencies have lower leverage.

In contrast to Uniswap, where you can expect a maximum of 20x, Ethereum offers up to 100x. Leveraged options are the second option available on Binance. A little sum called the “premium” is required to purchase these in advance. Also, according on your strategy, you can choose a strike rate and an expiration date.

Your monthly trading volume and the leveraged product you choose will determine the fees. One example is the possibility of trading futures for as little as 0.05% each slide. Options begin at a remarkably low 0.03%. Binance provides access to spot trading marketplaces in addition to its leveraged products. Our commissions begin at 0.01%.

Pros

- The largest cryptocurrency exchange in the world offers premium liquidity.

- More than 600 leveraged marketplaces are supported

- Leverage can be obtained through options or futures

- Extremely cheap commissions for trading

- There is live chat help accessible. All the time.

Cons

- Recently, Binance was fined over $4 billion for violating laws against money laundering.

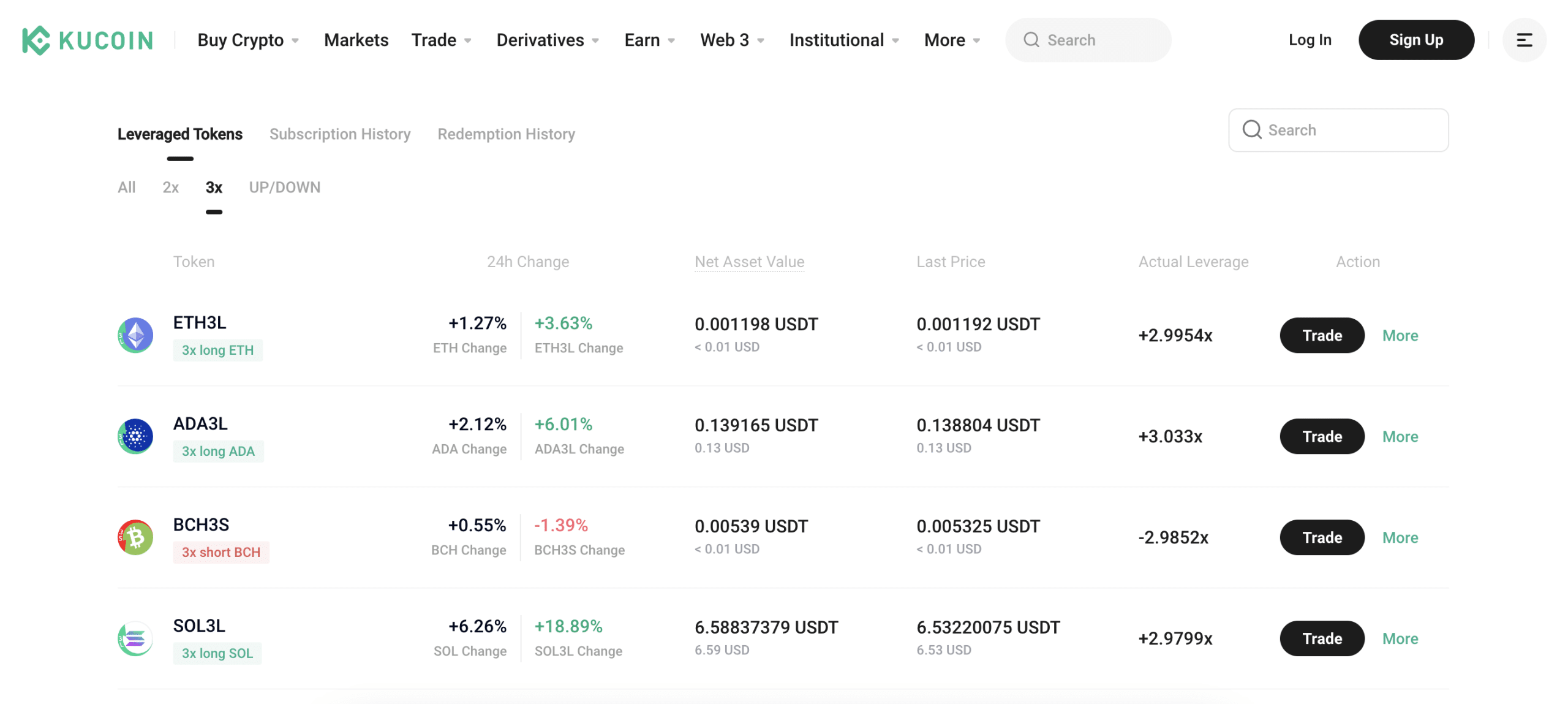

4.KuCoin

If you’re a trader worried about liquidation, KuCoin is for you. Without the need for loans, it provides leveraged token markets. On the contrary, KuCoin generates its own markets. Bitcoin, Ethereum, Bitcoin Cash, Arbitrum, and Solana are among the most widely used cryptocurrencies that can be traded. There is a long and short market for every coin that is supported.

Two- or three-fold leverage is at your disposal, depending on the coin in question. Depending on the number of long and short traders, you will receive somewhat more or less than the specified leverage amount. Consider the current leverage offer of 2.992x in the long Ethereum 3x market. Crypto futures are another feature that KuCoin offers with leveraged tokens.

Markets settled in USDT and USDC are covered by more than 245 distinct contracts. To settle your position in the underlying cryptocurrency, you can also use the inverse contracts that are available. With KuCoin, you can have a maximum leverage of 100x. Discounts are available for traders who engage in higher volume transactions, although the starting leverage fee for market takers is 0.06%.

Pros

- Gain three times the leverage without taking out loans or liquidations

- 100x leveraged perpetual and inverse futures

- Derivative trades of $1.3 billion were completed in the previous day.

- Numerous sophisticated trading instruments, such as technical indicators

Cons

- Commissions are higher than those of other suppliers, at 0.06%.

- KYC procedures that are mandatory for all new users

5.Kraken

If you’re a short-term trader, you might be interested in Kraken’s traditional margin accounts. A leverage of 5x is possible with a minimal margin requirement of only 20%. Ethereum, Bitcoin, Dash, Cardano, Solana, Arbitrum, and Dogecoin are among the over a hundred cryptocurrencies that are compatible. Limit and market orders are both supported by margin accounts.

Furthermore, short-selling is also legal, allowing you to bet on a decline in bitcoin prices. One major issue with Kraken is the exorbitant leverage costs. A fee of 0.02% of the trade value will be paid every four hours for each open margin position. To top it all off, opening and closing leveraged positions will cost you a commission.

From 0.01% to 0.02% is the range that applies to several cryptocurrencies. Moreover, leveraged futures markets are available on Kraken. There is a maximum leverage restriction of 50x and 95 different coins are compatible. Futures also have cheaper costs; the total amount you’ll pay is only 0.05% of your position amount. Rollover fees are not applicable, unlike margin accounts. This is crucial.

How to Choose Best Leverage Crypto Exchange?

For those who decide to proceed, the next step will be to choose the best cryptocurrency exchange with leverage. This is not always an easy process, as there are many online cryptocurrency exchanges that offer leveraged operations.

Choosing to trade with the cryptocurrency exchange with the highest leverage is not always the best choice, so some important factors must be considered when choosing a cryptocurrency exchange that also offers margin trading.

The various exchanges available often offer different levels of leverage, with some margin exchanges offering traders up to 100x leverage. The interest rate offered by a leveraged trade is an additional consideration, and depending on the duration of your position and the leverage, you could end up paying a fairly high rate.

Some cryptocurrency exchanges offer variable rates, including one or two major exchanges in the region, at 3.60% APR and 0.01% daily, which is a good rate for short-term positions.

Why Choose BTCC?

BTCC is known as the world’s longest-running exchange. Since its establishment, the platform has withstood multiple bull and downturn markets without reporting a single hacking incident, making it one of the most trusted exchanges in existence.

The firm’s products are designed to meet the needs and desires of both rookie and experienced traders. Here are five reasons for using the exchange:

- Available Cryptocurrencies on the Exchange

- Easy to use

- Reputable Customer Service

- BTCC Trading Features and Tools

- Welcome Bonus and Campaigns

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S.?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

- Online Customer Support

- Report an Issue

- [email protected]

- [email protected]

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*