Recommended

Learn

Support

Live ChatGet your questions answered by our live customer support

Futures

- USDT-M Perpetual FuturesTrade futures contracts settled in USDT

- USDT-M Perpetual Futures ProTrade futures contracts settled in USDT

- Coin-M Perpetual FuturesTrade futures contracts settled in cryptocurrency

- Demo Trading100,000 USDT virtual fundPractise trading USDT-margined and coin-margined futures

- Trading ArticlesRead all the guides about futures trading

Scan to Download App

Download OptionsEnglish

Proof of Reserves

BTCC maintains a reserve ratio of at least 1:1 for all user assets, promising 100% reserves and never misappropriating user funds. We regularly publish Merkle tree verification of platform reserves and user asset proof reports.

BTCC's Latest Reserve Ratio

Reserve Ratio = Platform Reserves ÷ All User Assets

A reserve ratio ≥100% indicates sufficient platform funds.

Report Time

2025-04-15(UTC+0)

Merkle Root Hash:

My Merkle Root Hash:

What is Proof of Reserve (PoR)?

Proof of Reserve is an audit procedure that verifies assets held by exchanges through cryptographic proof, public wallet ownership checks, and repeated audits. Custodians provide transparent proof that on-chain reserves truly exist, demonstrating that the total tokens held and freely available on the platform are greater than or equal to the total token assets of all users.

In centralized trading platforms, each user's assets are recorded through a ledger in a database. Securely proving that the platform is properly safeguarding all users' assets is a challenge that each platform must address.

BTCC uses Merkle tree tools to verify platform reserves and user asset proof reports, allowing users to verify their assets within the platform.

What is a Merkle Tree?

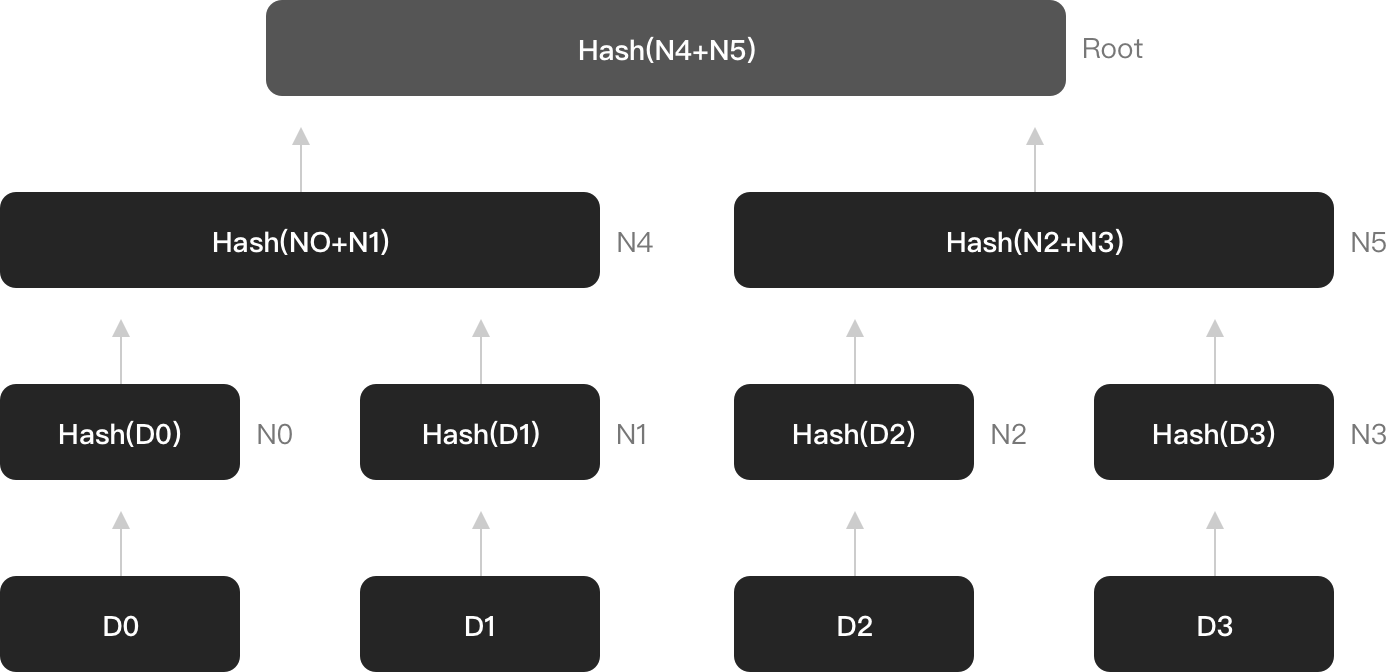

A Merkle Tree is a cryptographic tool used to efficiently verify data integrity. It can consolidate large amounts of data into a single hash value, known as the Merkle Root.

Each node at the bottom of the Merkle Tree represents an account. The balance and account name of each account are encrypted once through SHA256, and the resulting hash value is then calculated again with an adjacent hash value, proceeding layer by layer upward, ultimately resulting in the root of the Merkle Tree.

If users want to verify platform reserves, they need to follow the steps to first calculate the hash of their own account, locate their position in the tree and adjacent nodes, and calculate hashes layer by layer upward until they reach the root calculated by the user. If the root calculated by the user matches the officially published one, it proves that the platform's reserves are accurate.

As shown in the diagram below:

- Terms & Agreement

- Customer Service

- Online Customer Support

- Report an Issue

- [email protected]

- [email protected]

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2025 BTCC.com. All rights reserved